CHAPTER 5

BOND PRICES AND INTEREST RATE RISK

CHAPTER OVERVIEW AND LEARNING OBJECTIVES

CAREER PLANNING NOTE: PEOPLE HIRE PEOPLE

Organizations don’t hire people; people hire people. Don’t wait until a month before graduation to market yourself. Cultivate contacts and relationships now. Professors, advisors, guest speakers, and alumni are all potential networking partners. If you’ve particularly impressed a professor, let her know you’d like to be “on the radar screen” for opportunities she may know about. If you’re doing research, try to contact real-world experts. Most people are happy to talk about themselves and their work. They may not have an opportunity for you right away, but they may know someone else who does.

READING THE WALL STREET JOURNAL--THE MONEY & INVESTING SECTION

The Journal offers a daily course in financial markets in its “Money & Investing” section. This section summarizes “all the financial numbers”— key prices and rates as of the previous day’s closing of global financial markets. Understanding motivations of buyers and sellers in any market is as important as knowing the details of the transactions. In the classroom, we study valuation theories based on cash flow, risk, and time. In daily trading, other factors such as fear, greed, and politics play a part.

TOPIC OUTLINE AND KEY TERMS

I. The Time Value of Money: A dollar now is worth more than a dollar later.

A. Investing—in financial assets or in real assets—means giving up consumption until later.

1. The positive time preference for consumption must be offset by adequate return.

2. The opportunity cost of deferring consumption determines the minimum rate of return required on a risk-free investment.

a. Present cash sums may be theoretically invested at not less than this rate.

b. Future cash flows are discounted by at least this rate.

3. The time value of money has nothing primarily to do with inflation.

a. Inflation expectations affect the discount rate, but

b. Deferred consumption has an opportunity cost irrespective of inflation.

B. Future Value or Compound Value

1. The future value (FV) of a sum (PV) is FV = PV (1+i)n where

i is the periodic interest rate and

n is the number of compounding periods.

2. Compound future value interest factors, (1+i)n, are available in tables in terms of one dollar. Multiply by the PV to calculate the FV of an investment.

C. Present Value

1. The value now of a sum expected at a future time is given by

|

2. With risk present, a premium may be added to the risk-free rate. The higher the the discount rate, the lower the present value.

II. Bond Pricing

A. A bond is a form of loan—a debt security obligating a borrower to pay a lender principal and interest.

1. A borrower (issuer) promises contractually to make periodic cash payments to a lender (investor or bondholder) over a given number of years.

a. At maturity, the holder receives the principal (or face value or par value).

b. Periodically before maturity, the holder receives interest (coupon) payments determined by the coupon rate, the original interest rate promised as a percentage of par on the face of the bond.

2. A bondholder thus owns the right to a stream of cash flows:

a. an ordinary annuity of interest payments and

b. a future lump sum in the form of the return of the par value,

c. discountable to a present value at any time while the bond is outstanding.

B. The value (price) of a bond is the present value of the future cash flows promised, discounted at the market rate of interest (the required rate of return on this risk class in today’s market):

Where PB = the price of the bond or present value of the stream of cash payments;

Ct = the coupon payment in period t, where t = 1, 2, 3,…, n;

Fn = par value or face value (principal amount) to be paid at maturity;

i = market interest rate (discount rate or market yield); and

n = number of periods to maturity.

1. Cash flows are assumed to flow at the end of the period and to be reinvested at i. Bonds typically pay interest semiannually.

2. Increasing i decreases price (PB); decreasing i increases price; thus bond prices and interest rates move inversely.

C. Par, premium, or discount.

1. If market rate equals coupon rate, the bond trades at par.

2. If coupon rate exceeds market rate, the bond trades above par—at a premium.

3. If market rate exceeds coupon rate, the bond trades below par—at a discount.

D. Zero coupon bonds are “pure discount” instruments.

1. No periodic coupon payments.

2. Issued at discount from par.

3. Single payment of par value at maturity.

4. PB is simply PV of FV represented by par value, discounted at market rate.

III. Bond Yields

A. Bond yields are related to several risks—

1. Credit (default) risk: chance that issuer may not pay as agreed.

2. Reinvestment risk: potential effect of variability of market interest rates on return at which payments can be reinvested when received.

3. Price risk: Inverse relationship between bond prices and interest rates.

B. A yield is a market rate:

1. The discount rate at which price equals discounted PV of expected payments.

2. A measure of return ideally capturing impact of—

a. Coupon payments

b. Interest income from reinvestment of coupon interest

c. Any capital gain or loss

C. Common yield metrics: Yield to maturity, expected yield, realized yield, total return.

1. Yield to maturity: Investor's expected yield if bond is held to maturity and all payments are reinvested at same yield.

a. Normally determined by iteration—find discount rate such that bond price = present value of future payments (analogous to IRR of capital project).

b. The longer until maturity, the less valid the reinvestment assumption.

2. Expected yield: Predicted yield for a given holding period. Find in same way as YTM, but for some holding period shorter than maturity.

3. Realized yield: Ex post or “hindsight” actual rate of return, given cash flows actually received if reinvested at realized yield. May differ from YTM due to—

a. change in the amount or timing of promised payments (e.g. default).

b. change in market interest rates affecting premium or discount.

4. Total Return: Yield metric that considers capital gains or losses as well as changes in reinvestment rate. Find interest rate that compounds initial purchase price to sum of terminal value of bond plus future value of all coupon payments received (based on known or assumed reinvestment rate).

IV. Theorems of Bond Pricing

A. Bond price volatility (price risk) is the percentage change in bond price for a given change in interest rates:

![]() where %∆PB = the percentage change in price

where %∆PB = the percentage change in price

Pt = the new price in period t

Pt – 1 = the bond’s price one period earlier

B. Bond theorems summarized:

1. Bond prices are inversely related to bond yields.

2. The price volatility of a long-term bond is greater than that of a short-term

bond, holding the coupon rate constant.

3. The price volatility of a low-coupon bond is greater than that of a high-coupon,

bond, holding maturity constant.

V. Interest Rate Risk and Duration

A. Interest rate risk comprises price risk and reinvestment risk.

1. Price risk is the variability in bond prices caused by their inverse relationship with interest rates.

2. Reinvestment risk is the variability in realized yield caused by changing market rates at which coupons can be reinvested.

3. Price risk and reinvestment risk work against each other.

a. As interest rates fall—

(1) Bond prices rise but

(2) Coupons are reinvested at lower return.

b. As interest rates rise—

(1) Bond prices fall but

(2) Coupons are reinvested at higher return.

B. Duration is a measure of interest rate risk that considers both coupon rate and term to maturity.

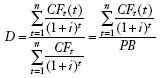

1. Duration is the ratio of the sum of the time- weighted discounted cash flows divided by the current price of the bond:

where: D = duration of the bond

CFt = interest or principal payment at time t

t = time period in which payment is made

n = number of periods to maturity

i = the yield to maturity (interest rate)

2. Duration concepts (all else equal):

a. Higher coupon rates mean shorter duration and less price volatility.

b. Duration equals term to maturity for zero coupon securities.

c. Longer maturities mean longer durations and greater price volatility.

d. The higher the market rate of interest, the shorter the duration.

e. Duration can be calculated for an entire portfolio:

![]()

where: wi = proportion of bond i in the portfolio and

Di = duration of bond i.

3. Duration is directly related to bond price volatility and is thus used as a measure of price risk:

![]()

4. Duration is the holding period for which reinvestment risk just offsets price risk so that the holder obtains the original, promised yield to maturity.

5. Duration is used by financial institutions to manage or control interest rate risk and actually achieve the desired yield for the desired holding period.

a. Zero-coupon approach: zero-coupon bonds have no reinvestment risk.

(1) The duration of a “zero” equals its term to maturity.

(2) Buy a zero with the desired maturity and lock in the yield.

(3) Must hold to maturity to evade price risk.

COMPLETION QUESTIONS

1. A dollar later is worth ____ than a dollar now.

2. If a bond is trading at a discount, the __________ rate is ____ than the market rate.

3. The __________ of a bond equals the discounted present value of payments promised from the bond.

4. As interest rates rise, bond prices _____.

5. The yield to maturity is the ______ yield; the ______ yield is the actual return on the bond.

6. In a fixed-rate bond, the __________ rate never changes.

7. With reference to the above question, __________ is the variable that provides bond traders the market yield to maturity.

8. Three bond risks are a) __________, b) __________, and c) __________.

9. Bond price volatility is the percentage change in __________ for a given change in __________.

10. Holding a bond to the duration point balances off __________ risk and __________ risk and assures the yield to __________.

TRUE-FALSE QUESTIONS

T F 1. Bond yields vary directly with changes in bond prices.

T F 2. The coupon rate varies inversely with bond prices.

T F 3. An increased demand for bonds lowers the market yield of the bond.

T F 4. Long-term bond prices vary more than short-term bond prices for any given change in interest rates.

T F 5. Yield to maturity on a coupon bond assumes that all coupons are reinvested at the same rate.

T F 6. If the coupon rate equals the market rate, a bond is likely to be selling at a discount.

T F 7. Duration is a measure of potential bond price volatility.

T F 8. A zero coupon bond has no reinvestment risk.

T F 9. The higher the coupon rate, the lower the bond price volatility.

T F 10. If market interest rates have risen since a bond was purchased, the bond’s price will have risen but the potential reinvestment yield on its coupons will have declined.

MULTIPLE-CHOICE QUESTIONS

1. In a fixed rate bond, the variable which changes to determine market rate of return is

a. price. b. coupon rate. c. coupon amount. d. face value.

2. An increase in the demand for bonds by SSUs will cause interest rates to

a. remain unchanged. b. increase. c. decrease.

3. What is the price of a $1,000 face value bond with a 10% coupon if the market rate of return is 10%?

a. more than $1,000 b. $1,000 c. less than $1,000 d. cannot ascertain

4. What is the price of the bond in the above question, if the market rate rises to 12% and the bond matures in 5 years? (Assume semiannual compounding.)

a. $829.60 b. $1,000.00 c. $926.40 d. $1,040.80

5. What is the price of the bond in question 3 above if the market rate drops to 8 percent?

a. $926.40 b. $1,000.00 c. $1,121.50 d. $1,081.11

6. What is the market price of a $1,000 face value zero coupon bond with a 5-year maturity priced to yield 11 percent, compounded annually?

a. $593.45 b. $650.00 c. $980.20 d. $1,000.00

7. The percentage change in bond price for any change in rates is called:

a. duration. b. volatility. c. reinvestment risk. d. basis point.

8. Bond price volatility is

a. inversely related to maturity and directly related to coupon rates.

b. directly related to maturity and inversely related to coupon rates.

c. inversely related to maturity and inversely related to coupon rates.

d. directly related to maturity and directly related to coupon rates.

9. Two factors that affect interest rate risk are

a. default risk and reinvestment risk.

b. price risk and interest rate risk.

c. reinvestment risk and price risk.

d. expected risk and realized risk.

10. Which of the following is true?

a. Bonds with higher coupon rates have longer durations, everything else the same.

b. The longer the maturity of a bond, the lower the duration.

c. Zero coupon bonds have durations greater than their maturities.

d. Coupon bonds have durations shorter than their maturities.

SUPPLEMENTARY PROBLEMS

A. Set this problem up in an Excel spreadsheet: A bond maturing in 4 years has a par value 40 times its semiannual coupon. Its yield to maturity is 3 times the current Fed Funds Rate. What is the bond’s duration?

Hint: Try plugging in different par values.

B. These fixed-rate bonds were issued at the same time by the same firm. Which has the shortest duration?

a. a zero-coupon bond maturing in 4 years

b. a bond with 8 semiannual interest coupons left to pay

c. a bond with 4 annual coupons left to pay

Hint: given what you know about duration, do you really have to try to calculate the exact duration of any of these instruments?

SOLUTIONS TO COMPLETION QUESTIONS

1. less

2. coupon; less

3. price

4. fall.

5. promised or expected; realized

6. coupon

7. price

8. credit or default risk, price risk and reinvestment risk

9. price; interest rates

10. price; reinvestment; maturity

SOLUTIONS TO TRUE-FALSE QUESTIONS

1. F Bond yields vary inversely with changes in bond prices.

2. F Bond coupon rates (fixed-rate bonds) remain constant.

3. T If bond prices increase, the market rate will decrease.

4. T Arithmetically, for any absolute change in rates, the present value discount factor changes by a greater multiple for long-term bonds than for short-term bonds.

5. T The actual, ex post, or realized yield may be higher or lower, depending on the movement of interest rates after the purchase of the bond.

6. F The bond will be selling at par or face value.

7. T Duration is a measure of price risk.

8. T With no coupon to reinvest, reinvestment risk is not present.

9. T For any change market rate, the present value of near term higher coupons changes very little. The price volatility of a zero coupon bond, with a single cash flow in the final “n” period, is very high because any change in the discount rate is compounded "n" times.

10. F As rates rise the bond price will fall, but coupons can be reinvested at higher yields.

SOLUTIONS TO MULTIPLE CHOICE

1. a Bonds are priced in the market; market rates are determined simultaneously.

2. c If bond prices increase, market rates vary inversely.

3. b If market rates remain at the coupon rate, the price of the bond will trade near $1,000.

4. c Find the present value of future cash flows discounted at 12 percent.

We have assumed semiannual compounding, thus we halve the discount rate and double the number of periods. The BP is the sum of a PV annuity (payment) $50.00 for ten periods plus the PV of the $1,000 (FV) in the tenth year. Calculator solution is:

1,000 FV 12/2 = 6 i 100/2 = 50 PMT 5 x 2 = 10 N

Solve for PV = $926.40

5. d Bond prices have been bid up in the market to yield 8%. The calculator solution is:

1,000 FV 5 x 2 = 10 N 8/2 = 4 i 100/2 = 50 PMT

Solve for PV = $1,081.11

6. a A zero coupon bond pays no interest. The price (PV) of the bond is found by discounting the maturity value at the market rate.

1,000 FV 5 N 11 i

Solve for PV = $593.45

7. b Bond volatility is a measure of price risk.

8. b Lower coupon, long-term bonds have the highest price risk.

9. c For any change in market rates, reinvestment and price risks have opposite effect.

10. d With coupon interest flows, reinvestment risk becomes a factor and the duration time becomes less than maturity.

Source: http://higheredbcs.wiley.com/legacy/college/kidwell/0470171618/sg/ch05.doc

Web site to visit: http://higheredbcs.wiley.com

Author of the text: indicated on the source document of the above text

If you are the author of the text above and you not agree to share your knowledge for teaching, research, scholarship (for fair use as indicated in the United States copyrigh low) please send us an e-mail and we will remove your text quickly. Fair use is a limitation and exception to the exclusive right granted by copyright law to the author of a creative work. In United States copyright law, fair use is a doctrine that permits limited use of copyrighted material without acquiring permission from the rights holders. Examples of fair use include commentary, search engines, criticism, news reporting, research, teaching, library archiving and scholarship. It provides for the legal, unlicensed citation or incorporation of copyrighted material in another author's work under a four-factor balancing test. (source: http://en.wikipedia.org/wiki/Fair_use)

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

The texts are the property of their respective authors and we thank them for giving us the opportunity to share for free to students, teachers and users of the Web their texts will used only for illustrative educational and scientific purposes only.

All the information in our site are given for nonprofit educational purposes