Introduction

1.1 Share-based payment has become increasingly common. Share-based payment occurs when an entity buys goods or services from other parties (such as employees or suppliers), and settles the amounts payable by issuing shares or share options to them.

1.2 If a company pays for goods or services in cash, an expense is recognized in profit or loss. If a company pays for goods or services in share options, there is no cash outflow and under traditional accounting, no expense would be recognized.

1.3 This leads to an anomaly if a company pays its employees in cash, an expense is recognized in the income statement, but if the payment is in share options, no expense is recognized.

1.4 HKFRS 2 Share-based payment was issued to deal with this accounting anomaly. HKFRS 2 requires that all share-based payment transactions must be recognized in the financial statements.

2. Types of Transaction

2.1 HKFRS 2 specifies the financial reporting by an entity when it undertakes a share-based payment transaction (SBPT). A SBPT is a transaction in which the entity:

(a) receives goods or services as consideration for equity instruments of the entity (including shares or share options); or

(b) acquires goods or services by incurring liabilities to the supplier of those goods or services for amounts that are based on the price of the entity’s shares or other equity instruments of the entity.

2.2 Goods include inventories, consumables, property, plant and equipment, intangible assets and other non-financial assets.

2.3 |

Types of SBPT |

|

(a) Equity-settled share-based payment transactions (equity-settled SBPT) – in which the entity receives goods or services as consideration for equity instruments of the entity (including shares or share options). |

3. General Recognition of SBPT

3.1 |

General recognition of SBPT |

|

HKFRS 2 requires that an entity should: |

3.2 |

Example 1 – Equity settled SBPT |

|||||||||

|

AC Ltd enters into a contract to buy 1,000 units of commodity at a price equal to 1,000 shares of its ordinary shares. AC Ltd’s ordinary share is $1 par value and worth $2 at the date of delivery. The entity settled the contract by issuing 1,000 ordinary shares at $2. The following entry should be made at the date of delivery:

|

3.3 |

Example 2 – Goods or services received or acquired do not qualify for recognition as assets |

||||||||||||

|

On 5 May 2012, ABC Ltd acquires some sundry laboratory equipment with a market value of $120,000 from its associates for its ongoing research project by issuing 100,000 of its ordinary shares (par value of $1 each). In this case, HKFRS 2 requires ABC Ltd to record the transaction on 5 May 2012 as follows:

|

4. Equity-Settled SBPT

4.1 Measurement of equity-settled SBPT with employees

4.1.1 Typically, shares, share option or other equity instruments are granted to employees as part of their remuneration package, in addition to a cash salary and other employment benefits. By granting shares or share options, in addition to other remuneration, the entity is paying additional remuneration to obtain additional benefits. However, estimating the fair value of those additional benefits is likely to be difficult.

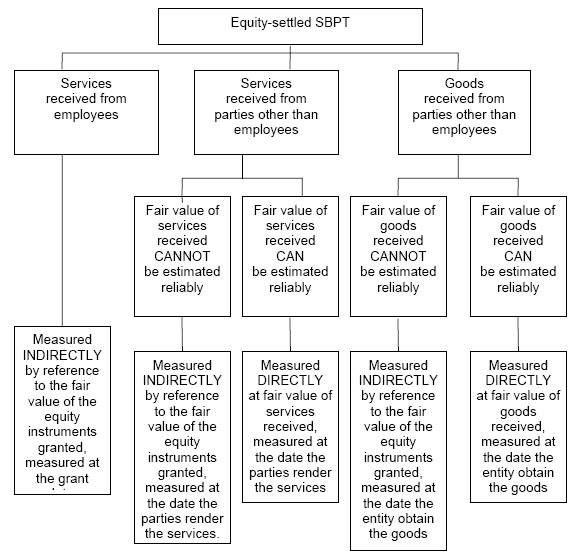

4.1.2 |

Measurement of equity-settled SBPT with employees |

|

(a) HKFRS 2 takes the position that it is usually not possible to measure directly the services received for particular components of the employee’s remuneration package. Because of the difficulty of measuring directly the fair value of the services received, the entity should measure the fair value of the employee services received by reference to the fair value of the equity instruments granted measured at grant date. |

4.1.3 |

Example 3 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

On1 October 2011, ABC Ltd (with 31 December accounting year-ends) approves a plan that grants the company’s top five executives options to purchase 200,000 shares each (a total of 1,000,000) of the company’s ordinary shares (par value $1.00) at $5.00 per share. The options are granted on 1 January 2012, and will vest on 1 January 2015 if the executives remain in the employment of the company until then. The options are exercisable from 1 January 2015 to 31 December 2018. Assume that, using the Black-Scholes model, the fair value of each option on 1 January 2012 is $1.50. In this case, the journal entries to record the share options are as follows:

If, on 10 January 2015, all the share options are exercised, the journal entry will be as follows:

If none of the share options are exercised and are eventually forfeited on 31 December 2018, the journal entry will be as follows:

|

4.2 Measurement of equity-settled SBPT with parties other than employees

4.2.1 For equity-settled SBPT transactions with parties other than employees, there is a rebuttable presumption that the fair value (measured at the date the entity obtains the goods or the counter-party renders service) of the goods or services received can be estimated reliably.

4.2.2 In rare cases, if the entity rebuts this presumption because it cannot estimate reliably the fair value of the goods or services received, the entity should measure the goods or services received, and the corresponding increase in equity, indirectly, by reference to the fair value of the equity instruments granted measured at the date the entity obtains the goods or the counter-party renders service.

4.2.3 |

Example 4 |

||||||||||||||||||||||||

|

Scenario A In this case, HKFRS 2 requires A Ltd to measure the transaction based on the fair value of the land, and record the transaction on 6 June 2012 as follows:

Scenario B B Ltd’s 1,000,000 ordinary shares are traded in the HKSE and are quoted at $22 per share on 6 June 2012. In this case, HKFRS 2 requires B Ltd to measure the transaction by reference to the fair value of shares issued, and record the transaction on 6 June 2012 as follows:

|

4.3 Effects of vesting conditions on recognition and measurement

4.3.1 If the equity instruments granted vest immediately, the employee or other party is not required to complete a specified period of service before becoming unconditionally entitled to those equity instruments. In the absence of evidence to the contrary, the entity should presume that services rendered by the counter-party as consideration for the equity instruments have been received. In this case, on grant date the entity should recognize the services received in full, with a corresponding increase in equity.

4.3.2 However, a grant of equity instruments under an equity-settled SBPT might be conditional upon satisfying specified vesting conditions, which must be satisfied for the employees or other parties to become entitled to equity instruments of the entity.

4.4 Performance condition

4.4.1 In many countries, share-based payments may be conditional not only when a future period of employment but also on the achievement of one or more performance conditions.

4.4.2 Under HKFRS 2, the treatment of a performance condition depends on whether or not it is a market condition. A market condition is a condition which the exercise price, vesting or exercisability of an entity instrument depends on the market price of the entity’s equity instruments.

4.4.3 Examples of market conditions includes:

(a) attainment (達到) of a specified share price,

(b) attainment of a specified amount of intrinsic value of a share option, and

(c) achievement of a specified target that is based on the market price of the entity’s share relative to an index of market prices of shares of other entities.

4.4.4 If the performance condition is a market condition, the probability of meeting the condition has already been taken into account in estimating the fair value of the option at the grant date, and hence no adjustment to amounts charged to the income statement is made if the market condition is not satisfied.

4.4.5 |

Example 6 – Performance condition is a market condition |

|||||||||||||||||||||||||||

|

On 1 October 2011, STU Ltd (with 31 December accounting year-ends) approves a plan that grants the company’s chief executive officer (CEO) options to purchase 500,000 shares of the company’s ordinary shares (par value $1.00) at $5.00 per share. The options are granted on 1 January 2012, and vest on 31 December 2014. However, the share options cannot be exercised unless the market price of the company’s shares has increased to at least $8.00 on 31 December 2014. The company uses the binomial option pricing model (which takes into account the probability that the share price may or may not exceed $8.00 on 31 December 2014) and estimates the fair value of the share option with this market condition to be $1.20 per option. Assuming the company expects the CEO to stay until after 31 December 2014, and the CEO does so, the journal entries to record the share options are as follows: (Whether the market condition is met will not affect the following entries.) The relevant accounting entries are as follows:

|

4.4.6 If the performance condition is not a market condition (for example, if it is tied to a specific growth in revenue, of profit or in earnings per share), it is not included in estimating the fair value of the option at the grant date.

4.4.7 Instead, non-market performance condition is subsequently considered at the end of each reporting period in assessing whether the equity instrument will vest. The assessment shall be based on the best available estimate of number of equity instruments expected to vest and shall revise that estimate, if subsequent information indicates that the number of equity instruments expected to vest differs from previous estimates. Further, on vesting date, the entity shall revise the estimate to equal the number of equity instruments that ultimately vested.

4.5 Modifications of equity-settled SBPT

4.5.1 An entity may alter the terms and conditions of share option schemes during the vesting period.

(a) For example, it might increase or reduce the exercise price of the options, which makes the scheme less favourable or more favourable to employees.

(b) It might also change the vesting conditions, to make it more likely or less likely that the options will vest.

4.5.2 |

General rule of modifications |

|

The general rule is that, apart from dealing with reductions due to failure to satisfy vesting conditions, the entity must always recognize at least the amount that would have been recognized if the terms and conditions had not been modified, i.e. if the original terms had remained in force. The incremental amount is the difference between the fair value of the modified equity instruments and the original equity instruments, both measured at the date of modification. |

4.5.3 |

Example 8 – A case of modification of the terms and conditions of employee share options where the exercise price of the option is changed (repricing) |

|||||||||||||||||||||||||||

|

On 1 October 2011, XYZ Ltd (with 31 December accounting year-ends) approves a plan that grants the company’s top five executives options to purchase 20,000 shares each (a total of 100,000) of the company’s ordinary shares (par value $1.00) at $5.00 per share. The options are granted on 1 January 2012, and will vest on 1 January 2015 if the executives remain in the employment of the company until then. The options are exercisable from 1 January 2015 to 31 December 2018. Assume that, using the Black-Scholes model, the fair value of each option on 1 January 2012 is $3.00. On 1 January 2013, the company reduces the exercise price of the share option to $4.00, in view of the expectation that the market price of the company’s share is not expected to exceed $5.00 in the next 3 – 4 years because of the world recession. The company estimates that, on 1 January 2013 (date of repricing), the fair value of each option before taking into account the repricing is $1.60, and the fair value of each repriced option is $1.80. In this case, the journal entries to record the share options are as follows: 1 October 2011 – No entry

|

4.6 Cancellations and settlements

4.6.1 |

Cancellations and settlements |

|

(a) If an entity cancels or settles a grant of equity instruments during the vesting period, HKFRS 2 provides that the entity shall account for the cancellation or settlement as an acceleration of vesting and therefore recongise immediately any settlement that otherwise would have been recognized in income statement. |

4.6.2 |

Example 9 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

XYZ Ltd is incorporated on 2 January 2011 to undertake research and development in a new field of science. In February 2011, the company approves a plan to grant its chief executive officer (CEO) options to purchase 1,000,000 of the company’s ordinary shares (par value $0.20) at $0.30 per share. The options are granted on 1 March 2011, and will vest on 1 January 2014 if the CEO remains in the employment of the company until then. The options are exercisable from 1 January 2014 to 31 December 2015. Given that the company is a new start-up in a new industry, it may be argued that the fair value of its equity instrument cannot be estimated reliably. The company thus measures the share option at their intrinsic value, as provided for under HKFRS 2. Assuming the company has a 31 December accounting year-end. Assume further that, based on net tangible asset backing per share, the fair value of the shares are estimated as follows: As at 1 March 2011: $0.30 per share The company’s share is quoted on the HKSE on 2 January 2014. The CEO exercised 200,000 of the options on 31 December 2014 when the market price is $0.60 per share and exercised the remaining 800,000 of the options on 31 December 2015 when the market price is $0.80 per share. In this case, the journal entries to record the share options are as follows:

1 February 2011 – No entry

Note that the total staff cost is $460,000 [($0.60 – $0.30) x 200,000 + ($0.80 – $0.30) x 800,000]. |

4.7 Amendment to HKFRS 2 Share-based Payment – Vesting Conditions and Cancellations

4.7.1 The amendment was issued by the HKICPA in March 2008 and is applicable, retrospectively, for annual periods beginning on or after 1 January 2009.

4.7.2 The amendments clarify:

(a) the definition of vesting conditions; and

(b) provide guidance on the accounting treatment of cancellations by parties other than entity.

4.7.3 |

Vesting conditions |

|

HKFRS 2 defines vesting conditions as:

|

4.7.4 Previously, HKFRS 2 was silent on whether features of a share-based payment transaction other than service conditions and performance conditions were vesting conditions. In the 2008 amendment to the standard, the IASB has clarified that only service and performance conditions are vesting conditions. Other features of a share-based payment are not, but should be included in the grant date fair value of the share-based payment.

4.7.5 |

Accounting treatment of cancellations by a party other than the entity |

|

Previous HKFRS 2 did not state how cancellations by a party other than the entity should be accounted for. The Amendment provides that if a share-based payment has a non-vesting condition and an entity or counterparty can choose whether to meet the non-vesting condition. Failure of the entity or counterparty to meet the non-vesting condition during the vesting period, should be treated as a cancellation. Upon cancellation, the entity should recognize immediately the amount of expense that would otherwise have been recognized over the remainder of the vesting period. |

4.7.6 |

Example 10 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

On 1 January 2011, ABC Ltd grants its chief executive office (CEO) the opportunity to participate in a plan in which the CEO obtains share options if he agrees to save 10% of his monthly salary of $100,000 for a three-year period. The monthly payments are made by deducting from the CEO’s salary. The CEO may use the accumulated savings to exercise his options at the end of the three years, or take a refund of his savings at any point during the three-year period. The estimated expense of the share-based payment arrangement is $36,000. In April 2012, the CEO stops paying contribution to the plan and takes a refund of contribution of $150,000 paid over the last 15 months. In this case, the requirement to pay contribution to the plan is a non-vesting condition. When the CEO chooses not to continue to make the contribution in April 2012, this event is treated as a cancellation. The journal entries will be as follows:

|

5. Cash-Settled Share-Based Payment Transactions

5.1 Cash-settled SBPT is defined as share-based payment transaction in which the entity acquires goods or services by incurring a liability to transfer cash or other assets to the supplier of those goods or services for amounts that are based on the price of equity instruments (including shares or share option) of the entity or another group entity.

5.2 |

Measurement of cash-settled SBPT |

|

(a) For cash-settled share-based payment transactions, HKFRS 2 requires an entity to measure the goods or services acquired and the liability incurred at the fair value of the liability. |

5.3 A common example of cash-settled SBPT is share appreciation rights granted to employees as part of their remuneration package. Under a share appreciation rights plan, an employee is entitled to cash payment (instead of equity instrument) in the future, based on the increase in the entity’s share price from a specific level over a specified period of time.

5.4 The liability shall be measured, initially and at each reporting period until settled, at the fair value of the share appreciation rights. It shall be measured by applying an option pricing model, taking into account the terms and conditions on which the share appreciation rights are granted, and the extent to which the employees have rendered service to date.

5.5 Where the share appreciation rights vest immediately, the entity will have to recognize the staff cost immediately. Where there is a vesting period, the staff cost is to be recognized over the vesting period.

5.6 The accounting treatment for cash-settled share-based payment transactions differs from that of equity-based payment transactions because the fair value applying an option pricing model is determined at each reporting period between the grant date and settlement date, not only at grant date.

5.7 |

Example 11 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

On 1 January 2011, JKL Ltd grants its chief executive officer (CEO) 1,000,000 share appreciation rights on the condition that she remains in its employment for the next three years. The market price of JKL Ltd’s share is $5.00 on 1 January 2011. Subsequently, the market prices are as follows: 31 December 2011: $5.50 Based on an option pricing model, the fair value of the share appreciation rights is estimated as follows: 31 December 2011: $0.90 The CEO exercises 400,000 of her rights on 31 December 2014 and the remaining 600,000 on 31 December 2015. The journal entries will be as follows:

Note that the total staff cost over the years is $2,600,000 ($800,000 + $1,800,000). |

Question 1 Required: Discuss the accounting treatment of the above event in the financial statements of the Ryder Group for the year ended 31 October 2005. (5 marks) |

6. Share-Based Payment Transactions to be Settled at Either Party’s Choice

6.1 HKFRS 2 requires that for share-based payment transactions in which the terms of the arrangement provide either the entity or the counter party with the choice of whether the entity settles the transaction in cash or by issuing equity instruments, the entity should account for that transaction, or the components of that transaction:

(i) as a cash-settled share-based payment transaction if, and to the extent that, the entity has incurred a liability to settle in cash or other assets; or

(ii) as an equity-settled share-based payment transaction if, and to the extent that, no such liability has been incurred.

6.2 HKFRS 2 prescribes specific accounting treatment depending on whether the entity or the counter-party has the choice.

6.3 The counter-party has the right to choose

6.3.1 In rare circumstance where an entity has granted the counter-party the right to choose whether a share-based payment transaction is settled in cash or by issuing equity instruments, the entity has, issued a compound financial instrument, with a debt component (i.e. the counter-party’s right to demand payment in cash) and an equity component (i.e. the counter-party’s right to demand settlement in equity instrument).

6.3.2 HKAS 32 “Financial Instruments: Presentation” requires split accounting for such compound financial instrument, and that the fair value of the debt component is to be determined first.

6.3.3 Consistent with the requirement of HKAS 32, HKFRS 2 requires that:

(i) for transactions with parties other than employees, in which the fair value of the goods or services received is measured directly, the entity shall measure the equity component of the compound financial instruments as the difference between the fair value of the goods or services received and the fair value of the debt component; and

(ii) for other transactions, including transactions with employees, the entity shall first measure the fair value of the debt component and then measure the fair value of the equity component, taking into account that the counter-party must forfeit the right to receive cash in order to receive the equity instrument.

6.3.4 On settlement date, HKFRS 2 requires that:

(i) if the counter-party demands settlement in equity instrument, the entity shall transfer the liability to equity, as the consideration for the equity instrument issued; and

(ii) if the counter-party demands settlement in cash, the entity should treat that payment as full settlement of the liability, any equity component previously recognized shall remain within equity.

6.4 The entity has the right to choose

6.4.1 For a share-based payment transaction in which the terms of the arrangement provide an entity with the choice of settlement, the entity shall determine whether it has a present obligation to settle in cash and account for the share-based payment transaction accordingly.

6.4.2 If the entity has a present obligation to settle in cash, HKFRS 2 requires the entity to account for the transaction as a cash-settled share-based payment transaction.

6.4.3 If no such obligation exists, HKFRS 2 requires the entity to account for the transaction as an equity-based share-based payment transaction. In such a case, HKFRS 2 provides that upon settlement:

(i) if the entity elects to settle cash, the cash payment shall be accounted for as the repurchase of shares; and

(ii) if the entity elects to settle by issuing equity instrument, no further accounting is required. Any excess payment should be recognized as an expense.

6.4.4 |

Example 12 |

||||||||||||||||||||||||||||||||||||||||||||||||

|

On 1 January 2011, LMN Ltd grants its CEO, as part of her remuneration package, the right to choose either 1,200,000 shares (par value $1.00 each) or 1,000,000 phantom shares under which she has the right to receive a cash payment equal to the value of 1,000,000 shares. The grant is conditional upon her completion of two years’ of service with the company. Further, if the CEO chooses the share alternative, the shares must be held for another two years after vesting date. The market price of the company’s shares are as follows: On 1 January 2011: $5.00 per share Based on an option pricing model, and having taken into account the post-vesting transfer restriction, the fair value of the share alternative is estimated to be $4.50 per share on grant date. In this case, the fair value of the compound instrument is $5,400,000 (1,200,000 × $4.50), the debt component (i.e. cash settlement) is $5,000,000 (1,000,000 × $5), and therefore the fair value of the equity component is $400,000 ($5,400,000 – $5,000,000). The journal entries will be as follows:

Assuming the CEO chooses cash settlement on 1 January 2013, the journal entry will be as follows:

However, if the CEO chooses for equity settlement on 1 January 2013, the journal entry will be as follows:

|

7. Share-Based Payment Transactions among Group Entities

7.1 For SBPT among group entities, in its separate or individual financial statements, the entity receiving the goods or services shall measure the goods or services received as either an equity-settled or a cash-settled SBPT by assessing:

(a) the nature of the awards granted; and

(b) its own rights and obligations.

7.2 The amount recognized by the entity receiving the goods or services may differ from the amount recognized by the consolidated group or by another group entity settling the share-based payment transaction.

7.3 |

Accounting treatment |

|

(a) The entity receiving the goods or services shall measure the goods or services received as an equity-settled SBPT when: |

7.4 The guidance can be illustrated for the most commonly occurring scenarios as follows:

|

|

|

Classification |

|

Entity receiving goods or services |

Obligation to settle SBPT |

How is it settled? |

Subsidiary’s financial statement |

Consolidated financial statements |

Subsidiary |

Subsidiary |

Equity of the subsidiary |

Equity |

Equity |

Subsidiary |

Subsidiary |

Cash |

Cash |

Cash |

Subsidiary |

Subsidiary |

Equity of parent |

Cash |

Equity |

Subsidiary |

Parent * |

Equity of parent |

Equity |

Equity |

Subsidiary |

Parent * |

Cash |

Equity |

Cash |

* The same classification will result if the settlement obligation lies with the shareholders or another group entity (e.g. a fellow subsidiary).

7.5 |

Example 13 |

|||||||||||||||||||||||||||||||||

|

On 1 October 2010, P Ltd approves a plan that grants the top five executives of its subsidiary, S Ltd, options to purchase 200,000 shares each (a total of 1,000,000) of P Ltd’s ordinary shares at $5.00 per share. The options are granted on 1 January 2011, vest on 31 December 2013, and may be exercised from 1 January 2014 to 31 December 2015. The group adopts 31 December accounting year-ends. Assume that using the Black-Scholes model, the fair value of each option is $1.50. In this case, HKFRS 2, requires the employees share ownership plan (ESOP) to be accounted for as an equity settled share-based payment transaction for S Ltd, P Ltd and the Group. The journal entries required to record the ESOP as at 31 December 2011 (as well as 31 December 2012 and 2013) are as follows:

As a result, in the Group financial statements: The effect is similar to the case where an entity issues its own equity instruments to its own employees under HKFRS 2. |

8. Disclosures

8.1 Entities should disclose information that enables users of the financial statements to understand the nature and extent of share-based payment arrangements that existed during the period. The main disclosures are as follows:

(a) a description of each type of share-based payment arrangement that existed at any time during the period.

(b) the number and weighted average exercise prices of share options:

(i) outstanding at the beginning of the period

(ii) granted during the period

(iii) forfeited during the period

(iv) exercised during the period

(v) expired during the period

(vi) outstanding at the end of the period

(vii) exercisable at the end of the period.

(c) for share options exercised during the period, the weighted average share price at the date of exercise.

(d) for share options outstanding at the end of the period, the range of exercise prices and weighted average remaining contractual life.

8.2 HKFRS 2 also requires disclosure of information that enables users of the financial statements to understand how the fair value of the goods or services received, or the fair value of the equity instruments granted, during the period was determined.

4.4.8 |

Example 7 – Performance condition is not a market condition |

|||||||||||||||||||||||||||

|

On 1 October 2011, LMN Ltd (with a 31 December accounting year-end) approves a plan that grants the company’s ten marketing executives options to purchase 10,000 shares each (a total of 100,000) of the company’s ordinary shares (par value $1.00) at $5.00 per share. The options are granted on 1 January 2012, and will be vested on either of the following dates: On 31 December 2012, sales increased by only 16%, but the company is confident that sales for 2013 will increase by at least 15% and therefore meet the vesting condition of a cumulative increase of 15%. During 2012, one of the marketing executives left the company, and the company expects another executive to leave during 2013. On 31 December 2013, sales only increased by 13%, but the company is confident that sales for 2014 will increase by at least 8%, and therefore meet the vesting condition of a cumulative increase of 10%. During 2013, one of the marketing executives left the company, and the company expects another executive to leave during 2014. On 31 December 2014, sales increased by 10%, and the vesting condition is met. None of the marketing executives left the company during 2014, and therefore a total of eight executives receive 10,000 shares each. In this case, the journal entries to record the share options are as follows:

Note that the total staff cost charged over the three years is $240,000 ($3 × 10,000 × 8). |

4.3.3 |

Example 5 |

|||||||||||||||||||||||||||

|

IK Ltd grants share options to each of its 100 employees working in the sales department. The share options will vest at the end of year 3, provided that the employees remain in the entity’s employment and that the volume of sales of a particular product increases by at least an average of 5% per year. If the volume of sales of the product increases by an average of between 5% and 10% per year, each employee will receive 100 share options. If the volume of sales increases by an average of between 10% and 15% each year, each employee will receive 200 share options. If the volume of sales increases by an average of 15% or more, each employee will receive 300 share options. On grant date, IK Ltd estimates that the share options have a fair value of $21 per option. It also estimates that the volume of sales of the product will increase by an average of between 10% and 15% per year, and therefore expects that, for each employee who remains in service until the end of year 3, 200 share options will vest. No employees will be expected to leave before the end of year 3. The relevant accounting entries are as follows:

Year 2

Year 3

Generally, vesting conditions are not taken into account when estimating the fair value of the shares or options at grant date. Vesting conditions are taken into account by adjusting the number of equity instruments included in the measurement of the transaction amount so that, ultimately, the amount recognized for goods or services received as consideration for the equity instruments granted is based on the number of equity instruments that eventually vest [e.g. 98 x (300 x $21) = $617,400] and this amount has been expensed over 3 years. |

Source: http://hkiaatevening.yolasite.com/resources/P2CRNotes/Ch6-ShareBased.doc

Web site to visit: http://hkiaatevening.yolasite.com

Author of the text: indicated on the source document of the above text

If you are the author of the text above and you not agree to share your knowledge for teaching, research, scholarship (for fair use as indicated in the United States copyrigh low) please send us an e-mail and we will remove your text quickly. Fair use is a limitation and exception to the exclusive right granted by copyright law to the author of a creative work. In United States copyright law, fair use is a doctrine that permits limited use of copyrighted material without acquiring permission from the rights holders. Examples of fair use include commentary, search engines, criticism, news reporting, research, teaching, library archiving and scholarship. It provides for the legal, unlicensed citation or incorporation of copyrighted material in another author's work under a four-factor balancing test. (source: http://en.wikipedia.org/wiki/Fair_use)

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

The texts are the property of their respective authors and we thank them for giving us the opportunity to share for free to students, teachers and users of the Web their texts will used only for illustrative educational and scientific purposes only.

All the information in our site are given for nonprofit educational purposes