1. The Risk Framework

1.1 Risk strategy and management

1.1.1 Risk management happens at three levels:

1.2 Business and financial risk

1.2.1 Business risk – The risk that a company's commercial activities and operations are less successful than in the past or as forecast (for example, a fall in revenues due to a competitor introducing a rival product).

1.2.2 Financial risk – The risk that financial conditions (for example, the cost of borrowing, the yield from investments, the availability of money to borrow, customer bad debts) could change or be less favourable than expected, resulting in a deterioration of business positions in financial terms (i.e. profitability and solvency).

1.3 Types of financial risk

1.3.1 Liquidity risk is the risk of having insufficient cash resources to meet day-to-day obligations, or take advantage of profitable opportunities when they arise. Liquidity is the ability to obtain:

1.3.2 Interest rate risk is the risk that adverse movements in interest rates will affect profit by increasing interest exposure or reducing interest income.

1.3.3 Foreign exchange risk is the risk that the rate of exchange used to convert foreign currency revenues, expenses, cash flows, assets or liabilities to the home currency will move adversely, resulting in reduced profitability and/or shareholder wealth.

1.3.4 Commodity price risk is the risk of a price change in a key commodity (input or putput) that would affect financial performance.

1.3.5 Credit risk is the risk that the other party to a financial transaction defaults and does not meet its financial obligations, or fails to meet its financial obligations on time. There are three key categories of credit risk:

(1) Counterparty risk – the other party to a financial transaction will not meet its obligations as to timing or amount of settlement.

(2) Country risk –

(3) Settlement or delivery risk – is the risk that there is default in a single settlement or delivery.

2. Exchange Rate System

2.1 Fixed exchange rate system:

2.2 Freely floating (clean float) exchange rate system:

2.3 Managed floating (dirty float) exchange rate system:

Question 1 – Exchange rate systems |

3. Types of Foreign Currency Risk

3.1 Transaction risk:

3.2 Economic risk:

3.3 Translation risk:

Example 1 – Transaction risk |

||||||||||||||||||||||||

A UK company, buy goods from Redland which cost 100,000 Reds (the local currency). The goods are re-sold in the UK for £32,000. At the time of the import purchases the exchange rate for Reds against sterling is 3.5650 – 3.5800. Required: Solution:

(b)(i) If the actual spot rate for the UK company to buy and the bank to sell the Reds is 3.0800, the result is as follows.

(b)(ii) If the actual spot rate for the UK company to buy and the bank to sell the Reds is 4.0650, the result is as follows.

This variation in the final sterling cost of the goods (and thus the profit) illustrated the concept of transaction risk. |

4. Causes of Exchange Rate Fluctuations

4.1 Balance of payments (國際收支平衡):

4.2 Purchasing power parity (PPP) (購買力平價學說):

![]()

Where: S0 = Current spot rate

S1 = Expected future rate

hb = Inflation rate in country for which the spot is quoted (base country)

hc = Inflation rate in the other country (country currency).

Example 2 |

||||||||||||||||

An item costs $3,000 in the US. Assume that sterling and the US dollar are at PPP equilibrium, at the current spot rate of $1.50/£, i.e. the sterling price x current spot rate of $1.50 = dollar price. The spot rate is the rate at which currency can be exchanged today.

The law of one price states that the item must always cost the same. Therefore in one year: By formula: |

Example 3 – Big Mac Index |

An amusing example of PPP is the Economist’s Big Mac Index. Under PPP movements in countries’ exchange rates should in the long-term mean that the prices of an identical basket of goods or services are equalized. The McDonalds Big Mac represents this basket. The index compares local Big Mac prices with the price of Big Macs in America. This comparison is used to forecast what exchange rates should be, and this is then compared with the actual exchange rates to decide which currencies are over and under-valued. |

4.3 Interest rate parity theory (IRP) (利率平價學說)

![]()

Where: F0 = Forward rate

S0 = Current spot rate

ic = interest rate for counter currency

ib = interest rate for base currency

Example 4 |

UK investor invests in a one-year US bond with a 9.2% interest rate as this compares well with similar risk UK bonds offering 7.12%. The current spot rate is %1.5/£. When the investment matures and the dollars are converted into sterling, IRP states that the investor will have achieved the same return as if the money had been invested in UK government bonds.

The forward rates moves to bring about interest rate parity amongst different currencies: By formula:

|

4.4 Expectations theory

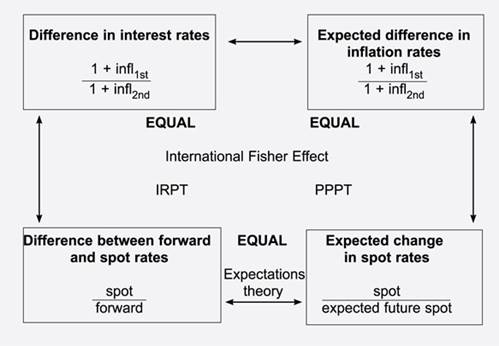

4.5 The international Fisher effect:

![]()

Where: ia = the nominal interest rate in country a

ib = the nominal interest rate in country b

ha = the inflation rate in country a

hb = the inflation rate in country b

4.6 Four-way equivalence:

5. Hedging Techniques for Foreign Currency Risk

5.1 Deal in home currency

5.1.1 Insist all customers pay in your own home currency and pay for all imports in home currency. This method:

5.2 Do nothing

5.2.1 In the long run, the company would “win some, loss some”. This method:

5.3 Leading and lagging

5.3.1 Lead payments:

5.3.2 Lagged payments:

5.4 Matching

5.4.1 When a company has receipts and payments in the same foreign currency due at the same time, it can simply match them against each other.

5.4.2 It is then only necessary to deal on the foreign exchange markets for the unmatched portion of the total transactions.

5.5 Netting

5.5.1 It only applies to transfers within a group of companies.

5.5.2 The objective is simply to save transactions costs by netting off inter-company balances before arranging payment.

5.5.3 It is not technically a method of managing exchange risk.

5.6 Forward contract

5.6.1 It is a contract with a bank covering a specific amount of foreign currency at an exchange rate agreed now.

5.6.2 Advantages and disadvantages:

Advantages |

Disadvantages |

|

|

5.7 Money market hedge

5.7.1 It involves borrowing in one currency, converting the money borrowed into another currency and putting the money on deposit until the time the transaction is completed.

5.7.2 Setting up a money market hedge for a foreign currency payment:

5.7.3 Setting up a money market hedge for a foreign currency receipt:

Question 2 – Objectives of working capital management, EOQ, AR management and foreign currency risk management Inventory management Accounts receivable management Accounts payable management

Money market rates available to PKA Co:

Assume that it is now 1 December and that PKA Co has no surplus cash at the present time. Required:

(a) Identify the objectives of working capital management and discuss the conflict that may arise between them. (3 marks) |

Question 3 – IRP, PPP and foreign currency risk management

Interest rates that can be used by ZPS Co:

Required: (a) Explain briefly the relationships between; |

6. Foreign Currency Derivatives

6.1 Currency Futures

6.1.1 A currency futures contract is a standardised contract for the buying or selling of a specified quantity of foreign currency.

6.1.2 It is traded on a futures exchange and settlement takes place in three-monthly cycles ending in March, June, September and December, ie a company can buy or sell September futures, December futures and so on.

6.1.3 The price of a currency futures contract is the exchange rate for the currencies specified in the contract.

6.1.4 When a currency futures contract is bought or sold, the buyer or seller is required to deposit a sum of money with the exchange, called initial margin.

6.1.5 If losses are incurred as exchange rates and hence the prices of currency futures contracts change, the buyer or seller may be called on to deposit additional funds (variation margin) with the exchange. Equally, profits are credited to the margin account on a daily basis as the contract is ‘marked to market’.

6.1.6 Most currency futures contracts are closed out before their settlement dates by undertaking the opposite transaction to the initial futures transaction, i.e. if buying currency futures was the initial transaction, it is closed out by selling currency futures. A gain made on the futures transactions will offset a loss made on the currency markets and vice versa.

6.1.7 Advantages and disadvantages:

Advantages |

Disadvantages |

(a) Transaction costs should be lower than other hedging methods. |

(a) The contracts cannot be tailored to the user’s exact requirements. |

Example 5 – Currency futures |

||||||||

A US company buys goods worth €720,000 from a German company payable in 30 days. The US company wants to hedge against the € strengthening against the dollar. Current spot is 0.9215 – 0.9221 $/€ and the € futures rate is 0.9245 $/€. Evaluate the hedge. Solution: 1. We assume that the three month contract is the best available. Net outcome

|

6.2 Currency options

6.2.1 |

Key Terms |

|

(1) Call option – gives the purchaser a right, but not the obligation, to buy a fixed amount of currency at a specified price at some time in the future. |

6.2.2 Currency options give holders the right, but not the obligation, to buy or sell foreign currency.

6.2.3 Over-the-counter (OTC) currency options are tailored to individual client needs, while exchange-traded currency options are standardised in the same way as currency futures in terms of exchange rate, amount of currency, exercise date and settlement cycle.

6.2.4 An advantage of currency options over currency futures is that currency options do not need to be exercised if it is disadvantageous for the holder to do so.

6.2.5 Holders of currency options can take advantage of favourable exchange rate movements in the cash market and allow their options to lapse.

6.2.6 The initial fee paid for the options will still have been incurred, however.

Example 6 – Currency options: Euro call option against Dollars |

A euro call option against dollars gives the buyer the right, but not the obligation, to purchase a certain amount of euros, such as €1 million, with dollars at a particular exchange rate, such as $1.20/€. If the spot exchange rate of dollars per euro in the future is greater than the exercise price of $1.20/€, the buyer of the option will exercises the right to purchase euros at the lower contractual price. When exercise the option, the buyer pays the seller of the option: €1 million × $1.20/€ = $1,200,000 And the seller delivers the €1 million. The buyer of the option can then sell the euros in the sport market for dollars at whatever spot rate. For example, if the spot rate is $1.25/€, the net dollar revenue from exercising the euro call option on €1 million is Notice also that the right to buy €1 million with dollars at the exchange rate of $1.20/€ us equivalent to the right to sell $1,200,000 for €1 million. This option is described as a dollar put option against the euro with contractual amount of $1.2 million and a strike price of Also, note that the buyer of the option could accept a payment of $50,000 from the seller of the option to close out the position rather than take delivery of the €1,000,000 and resell the euros in the spot market. Many option contracts are closed in this way, and this is how options on the NASDAQ OMX PHLX are settled. |

Example 7 – Currency options: Yen put option against Pound |

A Japanese yen put against the British pound in a European contract gives the buyer of the option the right, but not the obligation, to sell a certain amount of yen, say ¥100,000,000, for British pounds to the seller of the option at the maturity of the contract. The sale takes place at the strike price of pounds per 100 yen, say £0.6494 > ¥100. If the spot exchange rate of pounds per 100 yen at the exercise date in the future is less than the strike price, the buyer of the option will exercise the right to sell the ¥100,000,000 for pounds at the higher contractual price. When exercising the option, the buyer delivers ¥100,000,000 to the seller of the option, who must pay Suppose that the spot exchange rate at maturity is £0.6000/¥100 yen, which is less than the strike price. Then, the buyer of the option can purchase ¥100,000,000 in the spot foreign exchange market for £600,000 and sell the yen to the person who wrote the put contract. By exercising the option, the buyer of the yen put generates pound revenue equal to the difference between the exercise price of £0.6494/¥100 and the current spot price of £0.6000/¥100 multiplied by ¥100,000,000: Notice, also, that the right to sell ¥100,000,000 for British pounds at the exchange rate of £0.6494 / ¥100 is equivalent to the right to buy £649,400 with yen at the exchange rate of This latter option is a British pound call option against the Japanese yen. |

6.3 Currency swap

6.3.1 Currency swaps are appropriate for hedging exchange rate risk over a longer period of time than currency futures or currency options.

6.3.2 A currency swap is an interest rate swap where the debt positions of the counterparties and the associated interest payments are in different currencies.

6.3.3 A currency swap begins with an exchange of principal, although this may be a notional exchange rather than a physical exchange.

6.3.4 During the life of the swap agreement, the counterparties undertake to service each others’ foreign currency interest payments. At the end of the swap, the initial exchange of principal is reversed.

Example 8 – Currency swap |

Consider a UK company X with a subsidiary Y in France which owns vineyards. Assume a spot rate of £1 = 1.6 Euros. Suppose the parent company X wishes to raise a loan of 1.6 million Euros for the purpose of buying another French wine company. At the same time, the French subsidiary Y wishes to raise £1 million to pay new up-to-date capital equipment imported from the UK. The UK parent company X could borrow the £1 million sterling and the French subsidiary Y could borrow the 1.6 million Euros, each effectively borrowing on the other’s behalf. They would then swap currencies.

|

Question 4 – Debt finance, bond valuation and foreign currency risk management Each foreign bond has a par value of 500 pesos and pays interest in pesos at the end of each year of 6.1%. The bonds will be redeemed in five years’ time at par. The current cost of debt of peso-denominated bonds of similar risk is 7%. In addition to domestic sales, Boluje Co exports goods to the foreign country and receives payment for export sales in pesos. Approximately 40% of production is exported to the foreign country. The spot exchange rate is 6.00 pesos/$ and the 12-month forward exchange rate is 6.07 pesos/$. Boluje Co can borrow money on a short-term basis at 4% per year in its home currency and it can deposit money at 5% per year in the foreign country where the foreign bonds were issued. Taxation may be ignored in all calculation parts of this question. Required: (a) Briefly explain the reasons why a company may choose to finance a new investment by an issue of debt finance. (7 marks) |

7. Interest rate risk

7.1 Interest rate risk is faced by companies with floating and fixed rate debt. It can arise from gap exposure and basis risk.

7.2 Gap/interest rate exposure (差距風險)

7.3 Basis risk (基差風險)

Basis = Futures – Spot

8. Causes of Interest Rate Fluctuations

8.1 Term structure of interest rates

8.1.1 A key factor here could be the duration of the debt issues, linked to the term structure of interest rates. Normally, the longer the time to maturity of a debt, the higher will be the interest rate and the cost of debt.

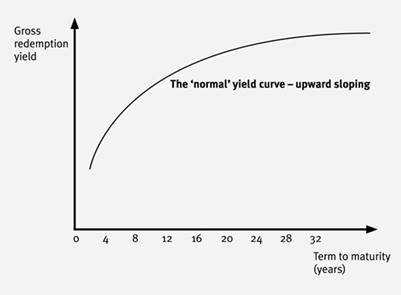

8.2 Yield curves

8.2.1 The yield curve is an analysis of the relationship between the yields on debt with different periods to maturity.

8.2.2 A yield curve can have any shape, and can fluctuate up and down for different maturities.

8.2.3 There are three main types of yield curve shapes: normal, inverted and flat (humped):

8.3 Factors affecting the shape of the yield curve

8.3.1 Liquidity preference theory:

8.3.2 Expectation theory:

8.3.3 Market segmentation theory:

Question 5 – Different bonds with different cost of debt |

8.4 Significance of Yield Curves to Financial Managers

8.4.1 Financial managers should inspect the current shape of the yield curve when deciding on the term of borrowings or deposits, since the curve encapsulates the market's expectations of future movements in interest rates.

9. Hedging Techniques for Interest Rate Risk

9.1 Matching and smoothing

9.1.1 Matching is where liabilities and assets with a common interest rate are matched, e.g. bank with fixed rate income prefer fixed rate finance.

9.1.2 Smoothing is where a company keeps a balance between its fixed rate and floating rate borrowing. In other words, balancing the % of debt that is fixed and floating.

Example 9 |

Subsidiary A of a company might be investing in the money markets at LIBOR and subsidiary B is borrowing through the same market at LIBOR. If LIBOR increases, subsidiary A’s borrowing cost increases and subsidiary B’s return increase. The interest rates on the assets and liabilities are therefore matched. |

9.2 Forward rate agreements (FRAs) (遠期利率協議)

9.2.1 A company can enter into a FRA with a bank that fixes the rate of interest for borrowing at a certain time in the future.

9.3 Interest rate futures

9.3.1 Interest rate futures can be used to hedge against interest rate changes between the current date and the date at which the interest rate on the lending or borrowing is set.

9.3.2 Borrowers sell futures to hedge against interest rate rises, lenders buy futures to hedge against interest rate falls.

Example 11 – Interest Rate Futures |

Interest rate futures can be used to hedge against interest rate changes between the current date and the date at which the interest rate on the lending or borrowing is set. Borrowers sell futures to hedge against interest rate rises, lenders buy futures to hedge against interest rate falls. Interest rate futures are notional fixed-term deposits, usually for three-month periods starting at a specific time in the future. The buyer of one contract is buying the (theoretical) right to deposit money at a particular rate of interest for three months. Interest rate futures are quoted on an index basis rather than on the basis of the interest rate itself. The price is defined as: P = 100 – i

|

Example 12 – Hedging three-month deposits |

||||||||

Futures profit

|

Example 13 – Hedging a loan |

£5m × 0.015 = £75,000

128 ticks × £12.50 × 10 contracts = £16,000 |

9.4 Interest rate options

9.4.1 An interest rate option grants the buyer of it the right, but not the obligation, to deal at an agreed interest rate (strike rate) at a future maturity date. On the date of expiry of the option, the buyer must decide whether or not to exercise the right.

9.4.2 Clearly, a buyer of an option to borrow will not wish to exercise it if the market interest rate is now below that specified in the option agreement. Conversely, an option to lend will not be worth exercising if market rates have risen above the rate specified in the option by the time the option has expired.

Example 14 – Interest rate option |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

Zuma has US$20 million of borrowings at a floating rate, US$ base rate + 0.75%, with a three month rollover. The treasurer is considering hedging the interest rate for the period starting on the next rollover date and has been offered a cap at 10% interest for a premium cost of 1% per annum payable quarterly in arrears. The effective interest rate paid for the quarter if Zuma buys the cap under each of the following scenarios is:

Use of 10% option (cap):

The option effectively caps Zuma's borrowing cost at a maximum of 11.75%, but allows the company to take advantage of any fall in interest rates. |

9.5 Interest rate caps (利率上限)

9.5.1 An interest rate cap is a contract that gives the purchaser the right effectively to set a maximum level for interest rates payable. Compensation is paid to the purchaser of a cap if interest rates rise above an agreed level.

9.5.2 This is a hedging technique used to cover interest rate risk on longer-term borrowing (usually 2 to 5 years). Under these arrangements a company borrowing money can benefit from interest rate falls but can place a limit to the amount paid in interest should interest rates rise.

9.6 Interest Rate Floors (利率下限)

9.6.1 An interest rate floor is an option which sets a lower limit to interest rates. It protects the floor buyer from losses resulting from a decrease in interest rates. The floor seller compensates the buyer with a payoff when the reference interest rate falls below the floor's strike rate.

9.7 Interest Rate Collar (利率上下限,利率兩頭封)

9.7.1 Using a collar arrangement, the borrower can buy an interest rate cap and at the same time sell an interest rate floor. This limits the cost for the company as it receives a premium for the option it’s sold.

Example 15 – Interest rate collar |

||||||||||||||||||||||||||||||||||||||||||||||||||

Suppose in the previous example (Example 14) Zuma is offered the cap at 10% interest, but the treasurer regards the cost of 1% per annum (pa) as too expensive. Upon negotiation, he discovers that bank is prepared to buy an 8% floor from Zuma for a premium cost of 0.75% per annum payable quarterly in arrears. Zuma purchases the 10% cap for 1% pa and sells the 8% floor for 0.75% pa giving a net cost of the collar of 0.25% pa. The effective interest rate paid for the quarter (under the same four scenarios) if Zuma buys the cap and sells the floor (ie buys the collar) is:

The collar between 9% and 11% effectively fixes Zuma's borrowing cost. |

9.8 Interest rate swaps (利率互換)

9.8.1 Interest rate swaps are where two parties agree to exchange interest rate payments. There is no exchange of principal.

9.8.2 Swap can be used to hedge against an adverse movement in interest rates.

Example 16 – Interest rate swap |

|||||||||||||||||||||||||||||||

There is a saving of 50 basis point or £750,000 per year. |

Example 10 |

||||||||||||||||||

A company’s financial projections show an expected cash deficit in two months' time of $8 million, which will last for approximately three months. It is now 1 November 2010. The treasurer is concerned that interest rates may rise before 1 January 2011. Protection is required for two months.

A 2-5 FRA at 5.00 – 4.70 is agreed. This means that:

Required: Calculate the interest payable if in two months’ time the market rate is: Solution:

In this case the company is protected from a rise in interest rates but is not able to benefit from a fall in interest rates – it is locked into a rate of 5% – an FRA hedges the company against both an adverse movement and a favourable movement. Note:

|

Additional Examination Style Question

Question 6

(a) It is 30 June. Bash Co will need a £20 million 6 month fixed rate loan from 1 October. The company wants to hedge using an FRA. The relevant FRA rate is 7% on 30 June.

(i) Explain how FRAs work and state what FRA is required in this situation.

(ii) Calculate the result of the FRA and the effective loan rate if the 6 month FRA benchmark rate has moved to

(1) 6%

(2) 9%

(b) Describe the likely implications to a typical company of lower interest rates.

(c) If you were the Financial Director of a company with a large investment programme and no capital gearing, explain what changes might result to both the investment programme and its financing as a result of falling interest rates.

Question 7

Discuss the use of exchanged traded and Over-The-Counter (OTC) derivatives for hedging and how they may be used to reduce the exchange rate and interest rate risks a company faces. Illustrate your answer by comparing and contrasting the main features of appropriate derivatives. (12 marks)

Source: https://hkiaatevening.yolasite.com/resources/QPMBNotes/Ch19-FinancialRisks.doc

Web site to visit: https://hkiaatevening.yolasite.com

Author of the text: indicated on the source document of the above text

If you are the author of the text above and you not agree to share your knowledge for teaching, research, scholarship (for fair use as indicated in the United States copyrigh low) please send us an e-mail and we will remove your text quickly. Fair use is a limitation and exception to the exclusive right granted by copyright law to the author of a creative work. In United States copyright law, fair use is a doctrine that permits limited use of copyrighted material without acquiring permission from the rights holders. Examples of fair use include commentary, search engines, criticism, news reporting, research, teaching, library archiving and scholarship. It provides for the legal, unlicensed citation or incorporation of copyrighted material in another author's work under a four-factor balancing test. (source: http://en.wikipedia.org/wiki/Fair_use)

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

The texts are the property of their respective authors and we thank them for giving us the opportunity to share for free to students, teachers and users of the Web their texts will used only for illustrative educational and scientific purposes only.

All the information in our site are given for nonprofit educational purposes