Chapter 5 HKAS 8 Accounting Policies, Changes in Accounting Estimates and Errors

1. Objectives

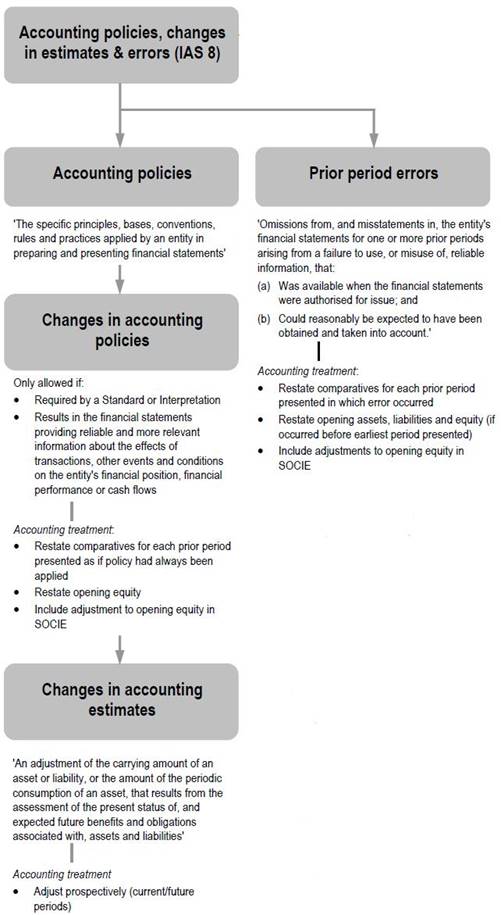

1.1 Define and identify accounting policies, change in accounting estimates, prior period errors, retrospective application, retrospective restatement and prospective application.

1.2 Distinguish between changes in accounting estimates and changes in accounting policies.

1.3 Describe the treatments for accounting errors and changes in accounting policy.

2. Definitions

2.1 |

Definitions |

|

(a) Accounting policies are the specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting financial statements. |

3. Accounting Policies

(A) Selection and Application of Accounting Policies

3.1 When an Accounting Standard or an Interpretation specifically applies to a transaction, other event or condition, the accounting policy or policies applied to that item should be determined by applying the Accounting Standard or Interpretation and considering any relevant Implementation Guidance for the Accounting Standard or Interpretation.

3.2 If there is no specific Accounting Standard or an Interpretation to follow, management should use its judgement in developing and applying an accounting policy that results in information that is:

(a) relevant to the economic decision-making needs of users; and

(b) reliable in that the financial statements:

(i) represent faithfully the financial position, financial performance and cash flows of the entity;

(ii) reflect the economic substance of transactions, other events and conditions, and not merely the legal form;

(iii) are neutral, that is, free from bias;

(iv) are prudent; and

(v) are complete in all material respects.

3.3 In making the judgement, management should refer to, and consider the applicability of, the following sources in descending order:

(a) the requirements and guidance in Accounting Standards and Interpretations dealing with similar and related issues; and

(b) the definitions, recognition criteria and measurement concepts for assets, liabilities, income and expenses in the Framework.

(B) Consistency of Accounting Policies

3.4 An entity shall select and apply its accounting policies consistently for similar transactions, other events and conditions, unless a Standard or an Interpretation specifically requires or permits categorisation of items for which different policies may be appropriate. If a Standard or an Interpretation requires or permits such categorisation, an appropriate accounting policy shall be selected and applied consistently to each category.

(C) Changes in Accounting Policies

3.5 |

Changes in Accounting Policies |

|

An entity shall change an accounting policy only if the change: The following are not changes in accounting policies: |

3.6 In the case of tangible non-current assets, if a policy of revaluation is adopted for the first time then this is treated, not as a change of accounting policy under HKAS 8, but as a revaluation under HKAS 16 Property, plant and equipment.

(D) Applying Changes in Accounting Policies

3.7 For applying changes in accounting policies, HKAS 8 provides the following:

(a) an entity shall account for a change in accounting policy resulting from the initial application of a Standard or an Interpretation in accordance with the specific transitional provisions, if any, in that Standard or Interpretation; and

(b) when an entity changes an accounting policy upon initial application of a Standard or an Interpretation that does not include specific transitional provisions applying to that change, or changes an accounting policy voluntarily, it shall apply the change retrospectively.

3.8 |

Key Point |

|

When a change in accounting policy is applied retrospectively, the entity shall adjust the opening balance of each affected component of equity for the earliest prior period presented and the other comparative amounts disclosed for each prior period presented as if the new accounting policy had always been applied. |

3.9 When retrospective application is required, a change in accounting policy shall be applied retrospectively except to the extent that it is impracticable to determine either the period-specific effects or the cumulative effect of the change.

3.10 When it is impracticable to determine the period-specific effects of changing an accounting policy on comparative information for one or more prior periods presented, the entity shall apply the new accounting policy to the carrying amounts of assets and liabilities as at the beginning of the earliest period for which retrospective application is practicable, which may be the current period, and shall make a corresponding adjustment to the opening balance of each affected component of equity for that period.

3.11 When it is impracticable to determine the cumulative effect, at the beginning of the current period, of applying a new accounting policy to all prior periods, the entity shall adjust the comparative information to apply the new accounting policy prospectively from the earliest date practicable.

3.12 When it is impracticable for an entity to apply a new accounting policy retrospectively, because it cannot determine the cumulative effect of applying the policy to all prior periods, the entity applies the new policy prospectively from the start of the earliest period practicable. It therefore disregards the portion of the cumulative adjustment to assets, liabilities and equity arising before that date.

3.13 |

Example 1 |

|

An entity has previously charged interest incurred in connection with the construction of tangible non-current assets to the statement of comprehensive income. Following the revision of HKAS 23 during June 2007, and in accordance with the revised requirements of that standard, it now capitalizes this interest. Since the change in recognition and presentation of interest incurred in connection with the construction of asset is required by the revised HKAS 23. Therefore it is a change in accounting policy. |

3.14 |

Exercise 1 |

||||||||||||

|

On 1 January 2005, Gamma Co changed its accounting policy for the treatment of borrowing costs that are directly attributable to the acquisition of a hydro-electric power station under construction for use by Gamma. In previous periods, Gamma had capitalized such costs. Gamma has now decided to treat these costs as an expense, rather than capitalize them. Management judges that the new policy is preferable because it results in a more transparent treatment of finance costs and is consistent with local industry practice, making Gamma’s financial statements more comparable. (1) Gamma capitalized borrowing costs incurred of $2,600 during 2004 and $5,200 in periods before 2004.

(5) 2004 beginning retained earnings was $20,000 and ending retained earnings was $32,600. Required: Prepare extract to the income statements and statements of changes in equity for 2005 and 2004, showing the cumulative effect of the change in accounting policy. (Disclosure notes are required.) |

4. Changes in accounting estimates

4.1 |

Key Point |

|

As a result of the uncertainties inherent in business activities, many items in financial statements cannot be measured with precision but can only be estimated. Estimation involves judgements based on the latest available, reliable information. For example, estimates may be required of: |

4.2 Changes in accounting estimates will be inevitable as a result of new information, more experience or subsequent developments. The revision of an estimate, by its nature, does not relate to prior periods and is not the correction of an error.

4.3 Applying changes in accounting estimates, the effect of the change should be recognised by including in profit or loss in:

(a) the period of change, if the change affects that period only; and

(b) the period of the change and future periods, if the change affects both.

4.4 For example, the effect of a change in estimate of the useful life of a depreciable asset affects the depreciation expense in the current period and in each period during the remaining useful life of the asset. Thus, the effect of the change relating to the current period should be included in the depreciation expense in the current period’s income statement. The effect, if any, on future periods is recognised in those future periods. A change in an accounting estimate applies the change to transactions, other events and conditions from the date of the change in estimate, and hence the financial statements of the prior period presented as comparative figures are not restated.

4.5 Where a change in an accounting estimate gives rise to changes in assets and liabilities, or relates to an item of equity, HKAS 8 provides that it should be recognised by adjusting the carrying amount of the related asset, liability or equity item in the period of the change.

4.6 If the change in an accounting estimate has an effect in the current period or is expected to have an effect in future periods, an entity should disclosure the nature and amount of the change, except for the disclosure of the effect on future periods when it is impracticable to estimate that effect. If the amount of the effect in future periods is not disclosed because estimating it is impracticable, that fact should be disclosed.

4.7 |

Exercise 2 |

|

Which of the following is a change in accounting policy as opposed to a change in estimation technique? (a) An entity has previously depreciated vehicles using the reducing balance method at 40% pa. It now uses the straight line method over a period of five years. |

5. Prior Period Errors

5.1 Errors discovered during a current period which relate to a prior period may arise through:

(a) Mathematical mistakes

(b) Mistakes in the application of accounting policies

(c) Misinterpretation of facts

(d) Oversights

(e) Fraud

5.2 The correction of material errors that relates to prior periods should be accounted for “retrospectively”, in the first set of financial statements authorized for issue after their discover by:

(a) restating the comparative amounts for the prior period(s) presented in which the error occurred; or

(b) if the error occurred before the earliest prior period(s) presented, restating the opening balance of assets, liabilities and equity for the earliest prior period presented.

5.3 The following disclosures are required:

(a) the nature of the prior period error;

(b) for each prior period presented, to the extent practicable, the amount of the correction for each financial statement line item affected; and if HKAS 33 “Earnings per Share” applies to the entity, for basic and diluted earnings per share;

(c) the amount of the correction at the beginning of the earliest prior period presented; and

(d) if retrospective restatement is impracticable for a particular prior period, the circumstances that led to the existence of that condition and a description of how and from when the error has been corrected.

5.4 |

Example 2 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(a) During 2005, XYZ Ltd. discovered that certain products that had been sold during 2004 were incorrectly included in inventory at 31 December 2004 at $6,500.

(d) 2004 opening retained earnings was $20,000 and closing retained earnings was $34,000. Required: Prepare extract to the income statements and statements of changes in equity for 2005 and 2004, showing the cumulative effect of the change in accounting policy. (Disclosure notes are required.) Solution:

XYZ Ltd.

Extract from notes to the financial statements 1. Certain products that had been sold in 2004 were incorrectly included in inventory at 31 December 2004 for $6,500. The financial statements of 2004 have been restated to correct this error. |

5.5 |

Exercise 3 |

||||||||||||||||||||||||

|

During 2007 a company discovered that certain items of research expenditure had been incorrectly capitalized as development expenditure at 31 December 2006. The amount of expenditure capitalized was $4 million. This research expenditure should have been included in cost of sales. The original figures reported for year ending 31 December 2006 and the figures for the current year 2007 are given below:

The opening retained earnings at 1 January 2006 were $50 million. The adjustment has no effect on the tax for the year. Required: Show the 2007 statement of comprehensive income and statement of changes in equity with comparative figures and the retained profits for each year. |

6. Disclosure

6.1 When initial application of a Standard or an Interpretation has an effect on the current period or any prior period, would have such an effect except that it is impracticable to determine the amount of the adjustment, or might have an effect on future periods, an entity shall disclose:

(a) the title of the Standard or Interpretation;

(b) when applicable, that the change in accounting policy is made in accordance with its transitional provisions;

(c) the nature of the change in accounting policy;

(d) when applicable, a description of the transitional provisions;

(e) when applicable, the transitional provisions that might have an effect on future periods;

(f) for the current period and each prior period presented, to the extent practicable, the amount of the adjustment:

(i) for each financial statement line item affected; and

(ii) if HKAS 33 “Earnings per Share” applies to the entity, for basic and diluted earnings per share;

(g) the amount of the adjustment relating to periods before those presented, to the extent practicable; and

(h) if retrospective application is impracticable for a particular prior period, or for periods before those presented, the circumstances that led to the existence of that condition and a description of how and from when the change in accounting policy has been applied.

6.2 When a voluntary change in accounting policy has an effect on the current period or any prior period, would have an effect on that period except that it is impracticable to determine the amount of the adjustment, or might have an effect on future periods, an entity shall disclose:

(a) the nature of the change in accounting policy;

(b) the reasons why applying the new accounting policy provides reliable and more relevant information;

(c) for the current period and each prior period presented, to the extent practicable, the amount of the adjustment:

(i) for each financial statement line item affected; and

(ii) if HKAS 33 applies to the entity, for basic and diluted earnings per share;

(d) the amount of the adjustment relating to periods before those presented, to the extent practicable; and

(e) if retrospective application is impracticable for a particular prior period, or for periods before those presented, the circumstances that led to the existence of that condition and a description of how and from when the change in accounting policy has been applied.

6.3 When an entity has not applied a new Standard or Interpretation that has been issued but is not yet effective, the entity shall disclose:

(a) this fact; and

(b) known or reasonably estimable information relevant to assessing the possible impact that application of the new Standard or Interpretation will have on the entity’s financial statements in the period of initial application.

Examination Style Questions

Question 1

(a) Set out below is a draft statement of retained profit for Thame Ltd for the year ended 31 March 2010 and the comparative figures for the year ended 31 March 2009.

Statement of retained profit

|

2010 |

2009 |

|

$000 |

$000 |

Retained profit for the year |

400 |

350 |

Retained profit at the beginning of the year |

500 |

150 |

Retained profit at the end of the year |

900 |

500 |

Two errors have just been discovered which consist of unreported profit that had been omitted from the above statement of retained profit. In the year ended 31 March 2008 there was an unreported profit before tax of $80,000 (tax $40,000) and in the year ended 31 March 2009 an unreported profit before tax of $100,000 (tax $45,000).

You are required to amend the above statement of retained profit in order to account for these two fundamental errors. (6 marks)

(b) State, with reasons, whether you consider the following events, which are all material, should be accounted for as prior period adjustments:

(i) A company changes its accounting policies in order to comply with a new Hong Kong Accounting Standard.

(ii) An error in the valuation of the closing inventories in the financial statements issued two years previously has been discovered.

(iii) The directors of a company engaged in a construction contract which had previously regarded it in the financial statements as a profitable contract and hence profit recognized (in accordance with HKAS 11 “Construction Contracts”) are now of the opinion that there will be a loss on the contract as a whole.

(iv) A computer, which was purchased three years ago for $100,000, was being depreciated at 15% per annum on the straight line basis, has been sold for $15,000.

(v) A company has leased premises for five years and the terms of the lease state that the tenant is responsible for all the repairs during the lease. The lease has expired and the landlord has requested a sum of $1 million for repairs necessary to restore the property to its former condition. The company has agreed to pay this sum because it has failed to repair the property during the lease periods.

(10 marks)

Question 2

HKAS 8 distinguishes between accounting policies and estimation techniques and the accounting for changes in each is very different.

Required:

(a) Distinguish between accounting policies and estimation techniques, as defined by HKAS 8 and state the differences in accounting for a change in accounting policy and a change in an estimation technique.

(b) For items (i) to (v) below, state in each case whether the proposed changes represent changes in accounting policies or estimation techniques, giving brief reasons.

(i) Depreciation of vehicles

(1) An entity has previously depreciated vehicles using the reducing balance method at 40% per year. It now proposes to depreciate vehicles using the straight-line method over five years, since it believes this better reflects the pattern of consumption of economic benefits.

(2) As in (1), an entity has previously depreciated vehicles using the reducing balance method at 40% per year and now proposes to depreciate vehicles using the straight-line method over five years. In addition, it has previously recorded the depreciation charge within cost of sales, but now proposes to include it within administrative expenses.

(ii) Classification of overheads

An entity has previously shown certain overheads within cost of sales. It now proposes to show those overheads within administrative expenses.

(iii) Indirect overheads recorded in the value of stock

A manufacturing entity has three indirect cost centres (A, B and C). It has previously assessed that the indirect costs attributable to production are 30% of A and 40% of B. Having reassessed the nature of those cost centres’ activities, it now assesses that the indirect costs attributable to production are 25% of A, 40% of B and 10% of C.

(iv) Capitalised finance costs

An entity has previously charged to profit and loss account interest incurred in connection with the construction of tangible fixed assets. It now proposes to capitalize such interest, as permitted by HKAS 16 “Property, Plant and Equipment”, since it believes this better reflects the cost of constructing those assets.

(v) Provisions

An entity has previously measured a particular provision on an undiscounted basis, in accordance with HKAS 37 “Provisions, Contingent Liabilities and Contingent Assets”, as the effect of discounting was not material.

However, this year it has revised upwards its estimates of future cash flows associated with the provision and, as a result, the effect of discounting is now material. HKAS 37 therefore requires it to report the provision at the discounted amount.

Question 3

(a) Describe the circumstances in which an entity may change its accounting policies and how a change should be applied. (5 marks)

(b) The terms under which Partway sells its holidays are that a 10% deposit is required on booking and the balance of the holiday must be paid six weeks before the travel date. In previous years Partway has recognised revenue (and profit) from the sale of its holidays at the date the holiday is actually taken. From the beginning of November 2005, Partway has made it a condition of booking that all customers must have holiday cancellation insurance and as a result it is unlikely that the outstanding balance of any holidays will be unpaid due to cancellation. In preparing its financial statements to 31 October 2006, the directors are proposing to change to recognising revenue (and related estimated costs) at the date when a booking is made. The directors also feel that this change will help to negate the adverse effect of comparison with last year's results (year ended 31 October 2005) which were better than the current year's.

Required:

Comment on whether Partway's proposal to change the timing of its recognition of its revenue is

acceptable and whether this would be a change of accounting policy. (6 marks)

(ACCA 2.5(HKG) Financial Reporting December 2006 Q5(b))

Question 4

Derringdo sells carpets from several retail outlets. In previous years the company has undertaken responsibility for fitting the carpets in customers’ premises. Customers pay for the carpets at the time they are ordered. The average length of time from a customer ordering a carpet to its fitting is 14 days. In previous years, Derringdo had not recognised a sale in income until the carpet had been successfully fitted as the rectification costs of any fitting error would be expensive. From 1 April 2002 Derringdo changed its method of trading by sub-contracting the fitting to approved contractors. Under this policy the sub-contractors are paid by Derringdo and they (the subcontractors) are liable for any errors made in the fitting. Because of this Derringdo is proposing to recognise sales when customers order and pay for the goods, rather than when they have been fitted. Details of the relevant sales figures are:

|

$000 |

Sales made in retail outlets for the year to 31 March 2003 |

23,000 |

Sales value of carpets fitted in the 14 days to 14 April 2002 |

1,200 |

Sales value of carpets fitted in the 14 days to 13 April 2003 |

1,600 |

Note: the sales value of carpets fitted in the 14 days to 14 April 2002 are not included in the annual sales figure of $23 million, but those for the 14 days to 14 April 2003 are included.

Required:

Discuss whether the above represents a change of accounting policy, and, based on your discussion, calculate the amount that you would include in sales revenue for carpets in the year to 31 March 2003. (5 marks)

(ACCA 2.5(HKG) Financial Reporting June 2003 Q3(d))

Question 5

You are the financial controller of Delta. Your assistant is preparing the first draft of the financial statements for the year ended 31 March 2011. He has a reasonable general accounting knowledge but is not familiar with the detailed requirements of all relevant financial reporting standards. There is one issue on which he requires your advice and he has sent you a memorandum as shown below:

On 1 April 2008 we bought a large machine for $5 million. We originally estimated a useful economic life of 5 years with no residual value. This estimate was used in previous years and the carrying value of the asset in the financial statements last year was $3 million. At 1 April 2010 we looked at these estimates again and now we think the original estimate was overoptimistic. The machine is unlikely to generate economic benefits for us after 31 March 2012 but on that date we could expect a scrap value of $200,000. We haven’t charged enough depreciation in 2008/09 and 2009/10 but I’m not sure how to reflect this – should I change my brought forward figures? (5 marks)

(ACCA Diploma in IFR Pilot Paper Q2)

Source: https://hkiaatevening.yolasite.com/resources/F7Notes/Ch5-HKAS8.doc

Web site to visit: https://hkiaatevening.yolasite.com

Author of the text: indicated on the source document of the above text

If you are the author of the text above and you not agree to share your knowledge for teaching, research, scholarship (for fair use as indicated in the United States copyrigh low) please send us an e-mail and we will remove your text quickly. Fair use is a limitation and exception to the exclusive right granted by copyright law to the author of a creative work. In United States copyright law, fair use is a doctrine that permits limited use of copyrighted material without acquiring permission from the rights holders. Examples of fair use include commentary, search engines, criticism, news reporting, research, teaching, library archiving and scholarship. It provides for the legal, unlicensed citation or incorporation of copyrighted material in another author's work under a four-factor balancing test. (source: http://en.wikipedia.org/wiki/Fair_use)

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

The texts are the property of their respective authors and we thank them for giving us the opportunity to share for free to students, teachers and users of the Web their texts will used only for illustrative educational and scientific purposes only.

All the information in our site are given for nonprofit educational purposes