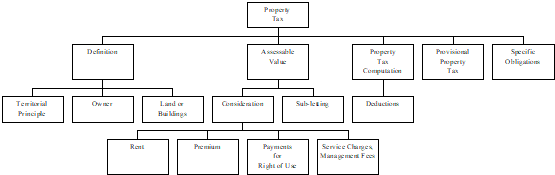

Chapter 1 Hong Kong Property Tax

1. Learning Outcomes

1.1 Describe what constitutes an “owner” of a property.

1.2 Identify the assessable value of a property.

1.3 Identify allowable deductions under property tax.

1.4 Compute property tax payable.

2. Introduction

2.1 Pursuant to Section 5 of the IRO, property tax (物業稅) is charged for each year of assessment on the owners of any land or buildings or land and buildings situated in Hong Kong, at the standard rate on the net assessable value (應評稅淨值)of such land or buildings or land and buildings.

2.2 |

DEFINITION |

|

Land or buildings or land and buildings is defined in Section 7A to include piers (碼頭), wharves and other structure. |

2.3 In other words, under territorial principle (屬地原則), only income derived from an immovable property situated in Hong Kong is taxable under property tax. It does not matter whether the owner is a Hong Kong resident or a foreigner.

2.4 If a Hong Kong resident earns income from an immovable property situated outside HK, the income is exempt from HK property tax even though the income is received in HK.

2.5 The standard rate is as follows:

Year of Assessment |

2003/04 |

2004/05 to 2007/08 |

2008/09 |

Standard rate |

15.5% |

16% |

15% |

2.6 In February 2008, the Financial Secretary proposed in the 2008/09 Budget to reduce the standard rate to 15% as from the year of assessment 2008/2009.

2.7 |

DEFINITION |

|

Owner in respect of land or buildings or land and buildings, is defined in Section 2 of the IRO to include the following persons: |

2.8 |

SCOPE OF CHARGE |

|

(a) Property tax is charged for each year of assessment on every person being the owner of any land or buildings situated in HK. |

3. Assessable Value (應評稅淨值)

(A) Types of income chargeable under property tax

3.1 |

DEFINITION |

|

Pursuant to Section 5B(2) of the IRO, the assessable value of land or buildings or land and buildings for each year of assessment shall be the consideration, in money or money’s worth, payable in that year to, to the order of, or for the benefit of, the owner in respect of the right of use of that land or buildings or land and buildings. “Consideration” (代價) includes any consideration payable in respect of the provision of any services or benefits connected with or related to the right of use (e.g. management or service fees payable to the owner). Consideration for the use of an immovable property includes the following: A deposit with the landlord that is provided for any possible damages to the premises and refundable upon the termination of a lease is not a consideration chargeable to property tax. |

3.2 Any consideration previously deducted as irrecoverable and recovered during any year of assessment (i.e. bad debt recovery) shall be treated as consideration payable in that year of assessment (i.e. taxable in the year of recovery).

3.3 Premium refers to the consideration payable in respect of a period of the right of use that is not contained within any one year of assessment.

3.4 For property tax purposes, the “premium” shall be deemed to be payable in equal monthly instalments, either:

(a) during the period of the right of use, or

(b) during a period of three years commencing at the start of the period of the right of use to which the consideration relates,

whichever is the shorter.

3.5 |

EXAMPLE 1 |

|

Mr Lau owns a flat and lets the flat to a person for a period of 2 years commencing on 1 June 2008 at a premium of $600,000. Compute the premium to be spread over and assessable in each relevant year of assessment. The premium is spread over 24 months (i.e. from 1 June 2008 to 31 May 2010) and assessable in the following years of assessment: Year of assessment 2008/09 Year of assessment 2009/10 Year of assessment 2010/11 |

3.6 |

EXERCISE 1 |

|

Mr Hui owns a flat and lets the flat to a person for a period of 5 years at a premium of $720,000 commencing on 1 January 2008. Required: Compute the premium to be spread over and assessable in each relevant year of assessment. |

3.7 Section 5B(2) provides that the assessable value of an immovable property is the consideration payable in the year of assessment. The consideration is taxable on an accrual basis, not on a cash basis. Thus, bad debts may arise from rents not paid by the tenant.

(B) Taxation of income from sub-letting (分租)

3.8 Property tax is a tax charged on the owners of immovable properties. If a person who is not the owner of an immovable property, but sub-lets the whole or part of the property to another person, and receives rental income from the property, the income so derived is not subject to property tax, but profits tax.

(C) Taxation of rental income received by unincorporated business and corporation

3.9 |

DEFINITION |

|

(a) It is defined in Section 2 that the letting or sub-letting by any corporation is treated as a business, and the income is included in the gross income of the company and subject to profits tax. |

3.10 If the owner of any land or buildings or land and buildings (“the property”) is a corporation, it should apply to the Commissioner in writing for an exemption from property tax under Section 5(2)(a) of the IRO if its rental income is chargeable to profits tax or the property is used or occupied for the purpose of producing chargeable profits.

3.11 Once the exemption is granted, the corporation is obliged to inform the Commissioner of any change in ownership or use of the property within thirty days after the change pursuant to Section 5(2)(c) of the IRO.

3.12 Under Section 25, if a person (including sole proprietorship, partnership and corporation) carries on a trade, a profession or a business, he or she may apply the paid property tax to set off against its profit tax liability.

3.13 If a partnership uses its own immovable property for business purposes, but the property is not fully utilized, and part of its is let to a third person, the income so derived may be assessed under profits tax, instead of property tax.

4. Property Tax Computation

4.1 |

DEFINITION |

|

Property tax is charged on the net assessable value of an immovable property tax. Net assessable value is defined in Section 5(1A) as the assessable value of land or buildings or land and buildings less the rates paid by him and a statutory deduction of 20%. |

4.2 The following deductions are allowable under property tax:

Allowable deduction |

Conditions |

Rates |

If the owner agrees to pay the rates in respect of the land or buildings or land and buildings, the rates paid by him are deductible from the assessable value. |

Bad debts |

Any consideration proved to the satisfaction of an assessor to have become irrecoverable during the year of assessment is deductible in ascertaining the assessable value. If there is no or insufficient assessable value for the deduction of the bad debts, the amount of unrelieved bad debts in that year can be carried backward and deducted from the assessable value in the latest year of assessment. |

Statutory outgoings |

There is a notional deduction for repairs and outgoings of 20% of the assessable value after deduction of any rates agreed to be borne and paid by an owner. Actual expenses incurred on repairs and maintenance are ignored for tax purposes. |

4.3 No deduction is allowed for interest paid on a loan to purchase the property unless an election is made for personal assessment.

4.4 The following is a general format of a property tax computation:

Property Tax Computation

|

4.5 |

EXAMPLE 2 |

|||||||||||||||||||||

|

Mr. X let a flat to Ms. Y at a monthly rent of HK$20,000 from 1 April 2006 to 30 September 2007. Mr. X would like to know his liability for property tax. Required: Compute the property tax payable by Mr. X. (Assume there is no bad debt and ignore provisional tax). Solution: The property tax payable by Mr. X is computed as follows:

* The Financial Secretary proposed in the 2008/09 Budget to waive 75% of the tax payable for the year of assessment 2007/08, subject to a maximum of $25,000. |

4.6 As mentioned in Example 2, a one-off rebate (一次過稅務寬減) of 75% property tax is made to all owners of properties in HK for the year of assessment 2007/08. The maximum amount of rebate for each property let is $25,000.

4.7 If a person owns two properties for rental income, he is entitled to a tax rebate for each property. In other words, he may be entitled to a total tax rebate of $50,000.

4.8 The tax rebate applies to the 2007/08 final tax only, but not to the provisional tax of the same year (2007/08) nor to the provisional tax of the following year (2008/09).

4.9 |

EXAMPLE 3 |

||||||||||||||||||||||||||||||||

|

Mr Gap owned a house in Sai Kung, and he let it to Mr Lau for a three-year lease from 1 January 2006 to 31 December 2008 at a monthly rent of $30,000, and a premium of $180,000 payable on 1 January 2006. Mr Gap paid the following expenses in connection with the property for the year ended 31 March 2008:

You are required to compute the property tax payable for the year of assessment 2007/08. Solution: Mr Gap

(Note: The Government rent, interest and repairs and improvement are not deductible under property tax.) |

4.10 |

EXERCISE 2 |

|

Based on the background information provided in Example 2 and assuming that, Ms. Y failed to pay the rent to Mr. X from 1 February 2007 and was subsequently declared bankrupt on 1 October 2007, Mr. X would have a bad debt of HK$160,000 (HK$20,000 × 8 months = HK$160,000) in 2007/08 while the assessable value of 2007/08 only amounts to HK$120,000 (HK$20,000 × 6 months). Required: (a) Advise Mr. X on the treatment of the bad debts. |

4.11 |

EXERCISE 3 |

|

Mr Bing owned a flat in Wanchai, and he let it to Mr Quit for a two-year lease from 1 April 2006 to 31 March 2008 at a monthly rent of $40,000. Mr Quit occupied the flat up to 30 April 2007, and disappeared. He did not pay the rent for the six months of November 2006 to April 2007. Mr Bing took back the flat on 1 May 2007, and let it to Mr Lo on 1 September 2007 at a monthly rent of $15,000. Mr Bing paid rates of $2,500 each quarter. Required: Compute the property tax payable for the years of assessment of 2006/07 and 2007/08. |

5. Provisional Property Tax (暫繳物業稅)

(A) Calculation of provisional property tax

5.1 The amount of provisional tax payable for a year of assessment is usually computed at the standard rate on the net assessable value of the land and/or buildings for the preceding year (s. 63M(1)).

5.2 |

EXAMPLE 4 |

|||||||||||||||||||||||||||||||||||||||

|

Winnie owns property S and let it to Diskson on 1 April 2007 for a term of three years at a monthly rent of $10,000 per month payable at the beginning of each month. Dickson is responsible to pay all the rates under tenancy agreement. The property tax liability of Winnie for the year of assessment 2007/08 (final) and the year of assessment 2008/09 (provisional) is calculated as follows:

However, if a person is newly chargeable or the preceding year is not a full year, an estimation can be made by an assessor based on the best information available to him (s. 63M(2) and 63M(3)). Normally the assessor will assess or estimate the amount of provisional property tax which an owner is liable to pay after the time limit for furnishing the return as expired. |

5.3 |

EXERCISE 4 |

|

Edwin owns Property T and let it to Mary on July 2007 for a term of two years for a monthly rent of $20,000 payable at the beginning of each month. Mary is responsible to pay all the rates under the tenancy agreement. Required: Calculate the property tax liability of Edwin for the year of assessment 2007/08 (final) and the year of assessment 2008/09 (provisional). |

(B) Holding over (緩繳暫繳稅) of payment of property tax

5.4 If a chargeable person considers that the provisional property tax is excessive, he can lodge a written application for holding over the payment of provisional property tax with the CIR. The application must be lodged not later than:

(a) 28 days before the due date of payment of provisional property tax; or

(b) 14 days after the date of the notice for payment of provisional property tax,

whichever is the later (s. 63O(1)).

5.5 The four specified grounds for holding over of payment for provisional property tax are:

(a) The assessable value is, or is likely to be, less than 90% of

(i) the assessable value for the preceding year of assessment, or

(ii) the estimated assessable value (s. 63O(2)(a)).

For example, if you are assessed to provisional property tax based on an assessable value of $300,000, you may apply for holding over of payment of provisional tax if the assessable value for the relevant year is, or is likely to be, less than $270,000.

This may occur in case of a reduction in rent or where the property is vacant for a certain period.

(b) The person has ceased, or will before the end of the year of assessment ceases, to be the owner of the land and/or buildings concerned and the assessable value for the year of assessment is, or is likely to be less than:

(i) the assessable value for the preceding year of assessment, or

(ii) the estimated assessable value (s. 63O(b)).

(c) The person chargeable has ceased personal assessment for that year of assessment and such personal assessment (個人入息課稅) is likely to reduce his property tax liability (s. 63O(c)).

(d) The person has lodged a valid objection to his assessment to property tax for the preceding year of assessment (s. 63O(d)).

6. Specific Obligations of Property Owners

(A) Keeping of sufficient rental records

6.1 Section 51D of the Inland Revenue Ordinance provides that any person who is the owner of land and/or buildings situated in Hong Kong is required:

(a) to keep sufficient records in English or Chinese of the rental income to enable the assessable value of that land and/or buildings to be readily ascertained, and

(b) to retain such records for a period of not less than seven years after the completion of the transactions, acts or operations to which they relate.

6.2 The preservation of the above records is not required if:

(a) the Commissioner of Inland Revenue has specified that such rental records need not be preserved, or

(b) the corporation that was the owner of the property has been dissolved.

6.3 If a person fails to comply with the preservation requirement without reasonable excuse, he is guilty of an offence punishable by a maximum fine of $10,000 (s. 80(1)(c)).

(B) Notification of changes in exemption status

6.4 Where the owner is a corporation exempted from property tax under s. 5(2)(a), the owner should notify the CIR in writing within 30 days of any change in the ownership or use of the property or any other circumstances affecting the exemption previously granted (s. 5(2)(c)).

(C) Responsibility of joint owners or co-owners

6.5 Where two or more persons are joint owners or owners in common of any property, each and every owner will have full responsibility for doing all such acts required to be done under the IRO as if he is the sole owner, including the filing of tax returns and paying the tax (s. 56A(a)).

6.6 Furthermore, this obligation does not relieve or affect any right or obligation of the joint owners or owners in common as between themselves (s. 56A(s)).

6.7 If any person has paid property tax for which he would not have been liable except for the provisions of s. 56A(1), he may recover such tax from the person who is liable (s. 56A(3)).

6.8 |

EXERCISE 5 |

|

Mr Tai owns the following properties: Property B Property C After losing his job, Mr Yiu was only able to pay the following rent to Mr Tai starting from 1 February 2007: Mr Yiu moved out of the property on 1 October 2007 and was then untraceable. On 1 February 2008, Mr Yiu was declared bankrupt. The property was then let to Mr Yung on 1 March 2008 under the following terms: After Mr Yiu had moved out of the property, Mr Tai paid the outstanding management fees of $7,200 owed by Mr Yiu on 15 October 2007. Mr Tai also incurred repairs and decoration expenses of $30,000 in the year of assessment 2007/08. You are advised that Mr Tai has not elected for personal assessment for any year of assessment. Required: (a) Compute Mr Tai’s property tax liabilities for each of the above properties for the years of assessment 2006/07 and 2007/08. Ignore provisional property tax. You are required to specify the reason(s) if Mr Tai is not subject to property tax in respect of a particular property. |

Source: https://hkiaatevening.yolasite.com/resources/P5Notes/Chapter1-HKPropertyTax.doc

Web site to visit: https://hkiaatevening.yolasite.com/

Author of the text: indicated on the source document of the above text

If you are the author of the text above and you not agree to share your knowledge for teaching, research, scholarship (for fair use as indicated in the United States copyrigh low) please send us an e-mail and we will remove your text quickly. Fair use is a limitation and exception to the exclusive right granted by copyright law to the author of a creative work. In United States copyright law, fair use is a doctrine that permits limited use of copyrighted material without acquiring permission from the rights holders. Examples of fair use include commentary, search engines, criticism, news reporting, research, teaching, library archiving and scholarship. It provides for the legal, unlicensed citation or incorporation of copyrighted material in another author's work under a four-factor balancing test. (source: http://en.wikipedia.org/wiki/Fair_use)

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

The texts are the property of their respective authors and we thank them for giving us the opportunity to share for free to students, teachers and users of the Web their texts will used only for illustrative educational and scientific purposes only.

All the information in our site are given for nonprofit educational purposes